Hdfc Multicurrency Forex Card Vs Regalia Forex Card

After seeing a massive success on the HDFC Regalia credit card by devaluing the points, looks like HDFC Bank now decided to use its past name and fame of "Regalia" to brand its new Forex card. HDFC has launched a new Forex card this month that revolves around the concept of – No Cross Currency Conversion Charges, which is indeed in high demand lately. HDFC that has a forex card for a while – HDFC Multicurrency ForexPlus Chip Card that also has similar features, but this new one does have significant advantage. Lets have a look,

HDFC Regalia ForexPlus Card

HDFC Bank Regalia ForexPlus Card Benefits

HDFC Says: "HDFC Bank Regalia ForexPlus Card is exclusively designed for globe trotters. No hassle of carrying multiple currencies or managing currency wallets, currency conversion charges are thing of the past."

Its clear that their previous multi-currency wallet concept seems to be too complicated for a normal person to understand and use, hence comes this new product. Lets dive into its features:

- Regalia ForexPlus Card Issuance Fee: Rs 1000/-

- Reload Fee: Rs 75/- per reload

- Balance Enquiry – 0.50 USD

- ATM Cash Withdrawal – 4 USD

#1 Zero Cross Currency Charges

It is the most important benefit that a Forex card needs. Now you get 0% Markup fee even if the transaction currency is different from the currency available on Regalia ForexPlus Card (USD). Problem solved?! No, there is a catch.

- GST on Currency conversion towards the purchase of Forex currency is applicable

They charge around ~2%+GST or so (which they usually charge on HDFC multicurrency forexplus card) on purchase, which is nothing but the markup fee. Hence, you're actually paying the markup fee upfront.

Its not fair for the so called "India's #1 bank" (as they brand so) to hide this fee and promote it as 0% markup fee card.

HDFC Bank Regalia ForexPlus Card Charges

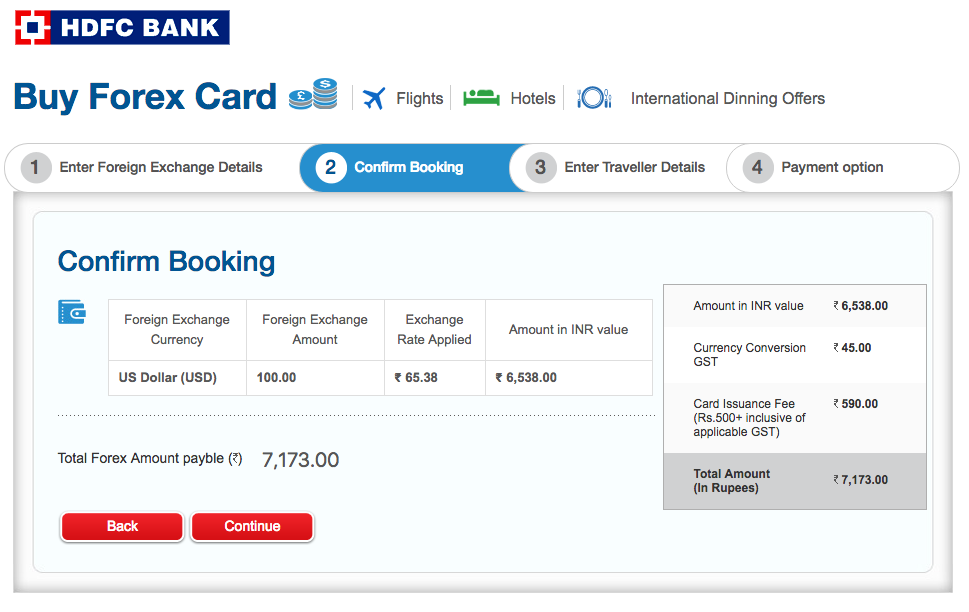

Here are the numbers exposed for $100 forex card when XE Rate: 1$ = 64.4

- Actual Rate: Rs.64.4

- Bank conversion Rate = Rs.65.38 (~1.5%)

The good part is this card runs on Mastercard network which gives you the best exchange rate (when you use on other currencies) as per the recent research. More on it here: Visa vs MasterCard vs Amex vs Diners Club – Which has the Best Foreign Exchange Rate?

#2 Complimentary Lounge Access

- Complimentary International Airport Lounge Access in India (Limits Not disclosed)

This means, you'll get complimentary access to mastercard airports lounges in terminals with international departures only. They haven't disclosed the max. limits yet. This maybe be like 2/qtr as usual.

#3 Online Usage Enabled

Bank allows E-commerce facility on Regalia ForexPlus Cards to make payments towards shopping done on online website / shopping portals. In case of Ecom transactions, the system may prompt for second factor authentication where you need to validate the transaction using the NetBanking PIN for your Regalia ForexPlus Card.

So any left-off currency after your trip, you may consider splurging on sites like AliExpress. Though, not sure how practical it is.

#4 Cashback of 5% or 5X Reward Points Offer (limited period)

- Debit cards: 5% Cashback limited to Rs. 2500

- Credit cards: 5X Reward Points Limited to 2500 Reward points for

This is indeed the major benefit if you're considering to get this card. Loading your Regalia Forex Plus card with Rs.50,000 using a HDFC debit card will get you Rs.2500 cashback which will set off the issuance fee & the markup fee. Same with credit cards, makes sense if you hold Infinia or Diners Black to avail 5X reward points.

Other Benefits: There are other benefits like 'Thanks Again' Reward Program by MasterCard and 'Waiver on ATM Access Fee or ATM ownership charges', however both are limited to a small network, hence not a major feature to rely on.

Final words:

If at all you're going for this Regalia Forex Plus card, its worth it if and only if you do so by availing the 5%/5X offer mentioned above. Else, you loose a net ~2%+GST and additional withdrawal charges. Consider Indusind Exclusive Platinum DEBIT card or Indusind Exclusive Signature DEBIT card for any withdrawals.

Be aware that using debit cards abroad is not suggested as its not that secure as Credit card, which is one of the major reasons to hold a credit card. Hence you might rather go for any of the cards that we've listed for international transactions (but never withdraw from credit cards). Here you go -> 7 Best Indian Credit Cards for International Travel.

What's your take on HDFC's new Regalia ForexPlus Card? Worth the hype or yet another fail? Feel free to share your views in comments below.

Hdfc Multicurrency Forex Card Vs Regalia Forex Card

Source: https://www.cardexpert.in/hdfc-bank-regalia-forexplus-card-review/

0 Response to "Hdfc Multicurrency Forex Card Vs Regalia Forex Card"

Post a Comment