Bd Swiss Forex Trading Platform Review

Review

BDSwiss was established in 2012, and swiftly embarked on what is seen as a remarkable growth trajectory. While this broker describes itself as part of a worldwide operating group with holdings in Switzerland, the primary regulator appears to be the Cyprus Securities and Exchange Commission (CySEC). BDSwiss is also regulated by the Financial Services Commission of Mauritius which allows the broker to offer non-EU residents more flexible leverage options. The broker is home to over 1.3 million accounts, over 30 billion in average monthly Forex volume (as of 2019 figures). Forex and commodity trading remains commission-free. Commodities, indices, and equity CFDs are acceptably priced.

Back to Top

Regulation and Security

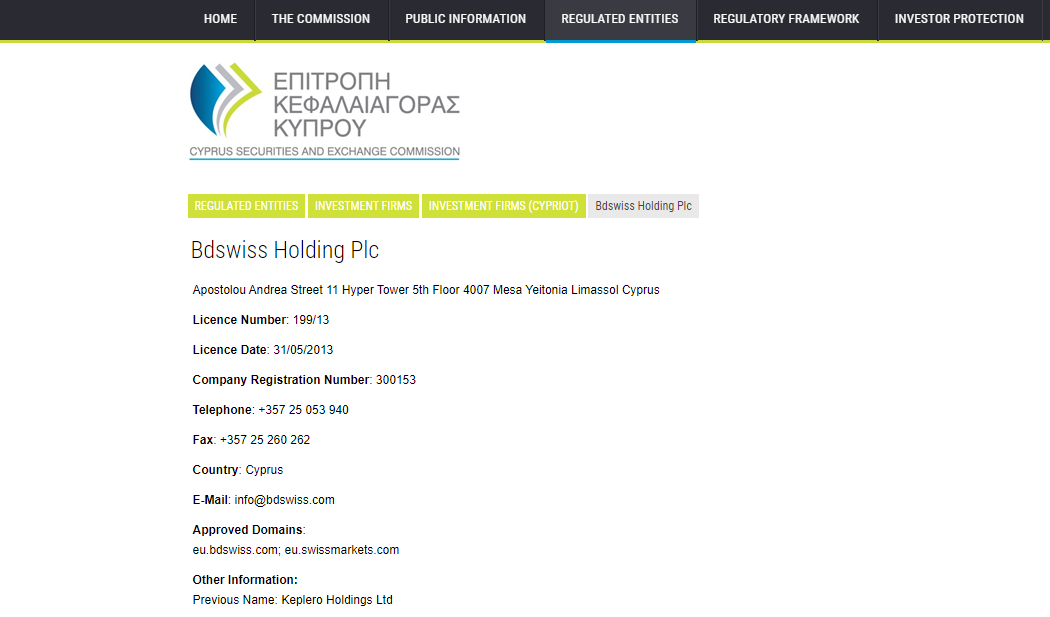

From the About section on the company's global website, it appears that the name BDSwiss was intended as an homage to the country (Switzerland) of one of the founding members. The EU website indicates that BDSwiss currently has holdings in Zug, Switzerland. As regards BDSwiss regulators, the primary regulator appears to be the Cyprus Securities and Exchange Commission (CySEC).The broker is fully compliant with the EU's Financial Instruments Directive 2014/65/EU or MiFID II and the EU's 5th Anti-Money Laundering Directive. Client deposits are protected under the Investor Compensation Fund (CIF), per EU Directive 2014/49/EU, up to a maximum of €20,000. Cross-border regulation across EU member countries applies.

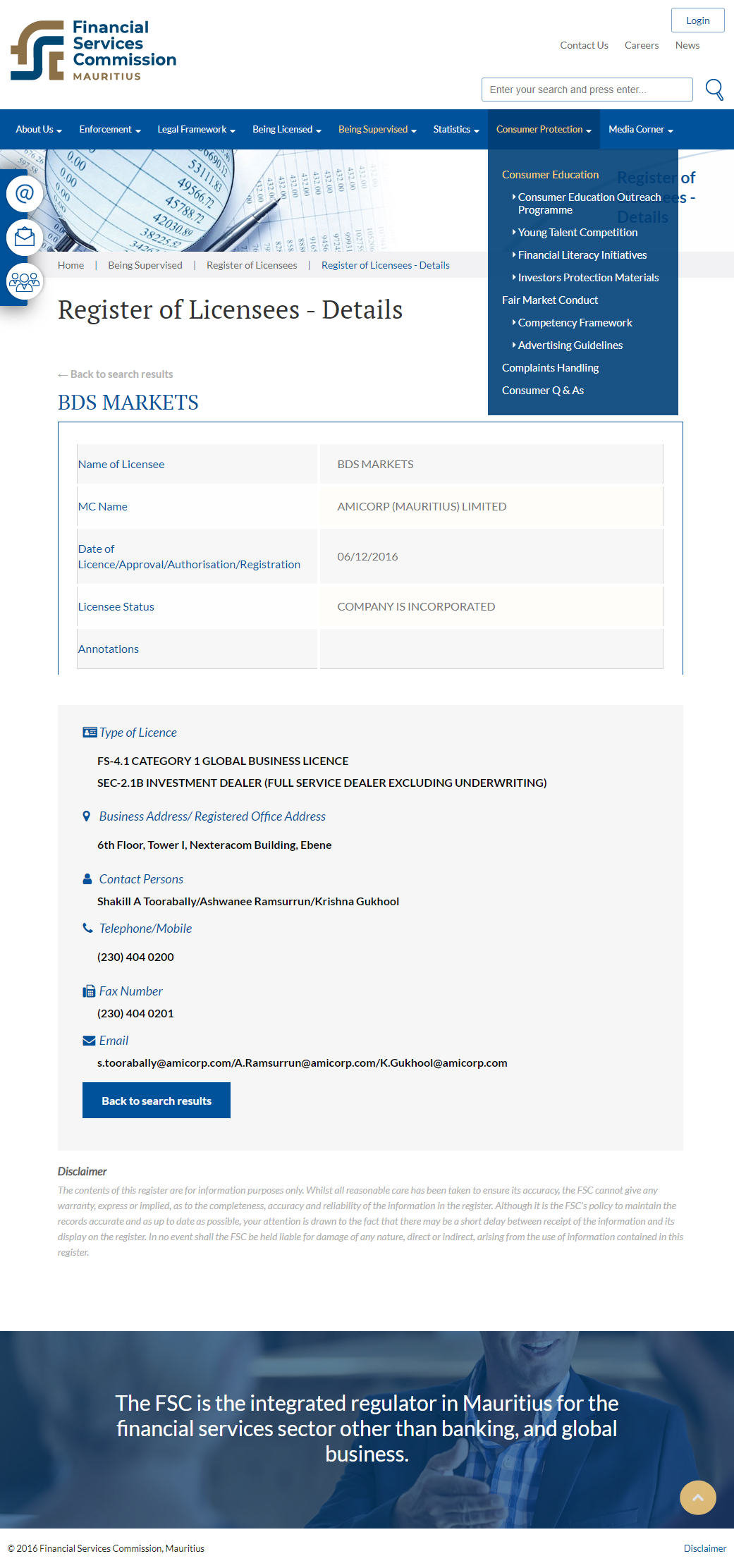

BDSwiss LLC, is registered with the US National Futures Association. BDS Markets holds an Investment Dealer license issued by the Financial Services Commission of Mauritius. BDSwiss GmbH is a Tied Agent registered in Germany. The overall regulatory environment for BDSwiss is satisfactory.

BDSwiss indicates that its worldwide operating group has holdings in Switzerland.

Four regulatory jurisdictions create the framework under which this broker operates.

The primary regulatory agency is the Cyprus Securities and Exchange Commission.

BDSwiss is also authorised and regulated as an Investment Dealerby the FSC Mauritius License No. C116016172

Back to Top

Fees

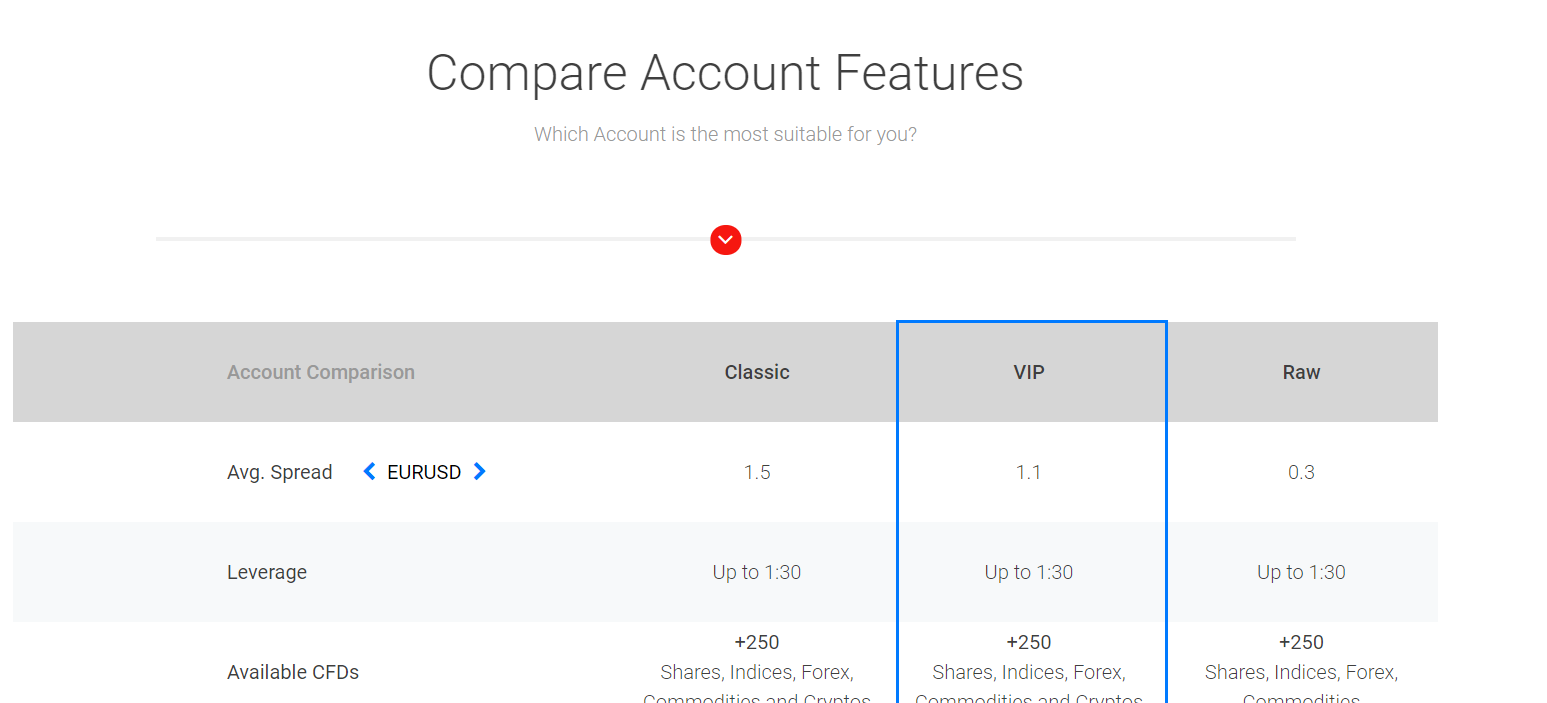

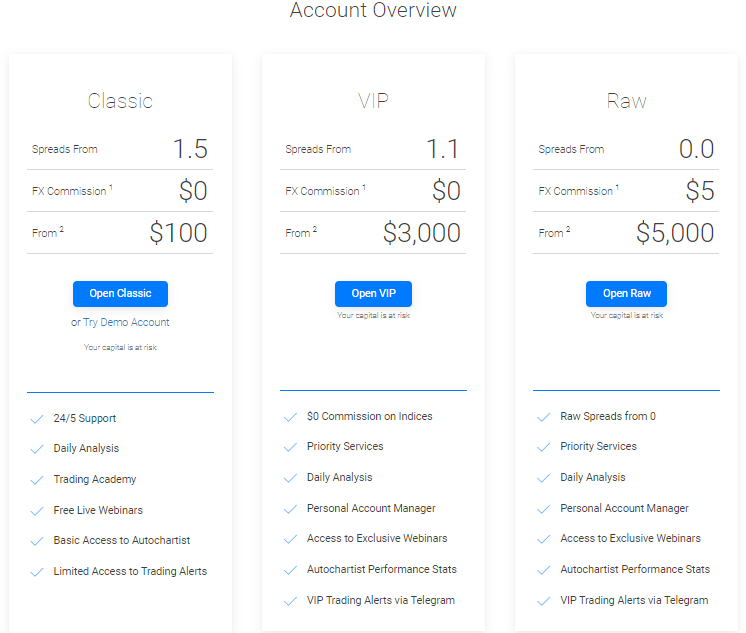

While a combination of spreads and commissions accounts for the bulk of fees, BDSwiss also provides a premium Raw Account with spreads starting from 0 pips and commissions set at $5 per traded lot. The classic account carries an averagespread of 1.5 pips, an unacceptable mark-up relative to the industry. A reduction to an average of 1.1 pips in the VIP account is combined with up to 40% lower commissions on all indices and shares. Forex, cryptocurrencies, and commodities are commission-free. This broker deploys a reasonable fee structure for index CFDs at $2 per lot, and a 0.15% charge per share applies to equity CFDs.

The broker's most competitive offer is a unique approach across the brokerage industry, consisting of a competitive Raw account which can be accessed for a $5000 account balance. Commissions per traded lot are set at $5.Swap rates on overnight leveraged positions apply. Corporate actions such as dividends and mergers will impact equity and index CFDs (though BDSwiss does not openly outline how corporate actions are processed). An inactivity fee of 10% of the account balance (which will range from €25 to €49.90 or account currency equivalent) will be charged after 90 days.

The EUR/USD carries an average spread of 0.3 pips in the Raw account.

Back to Top

What Can I Trade

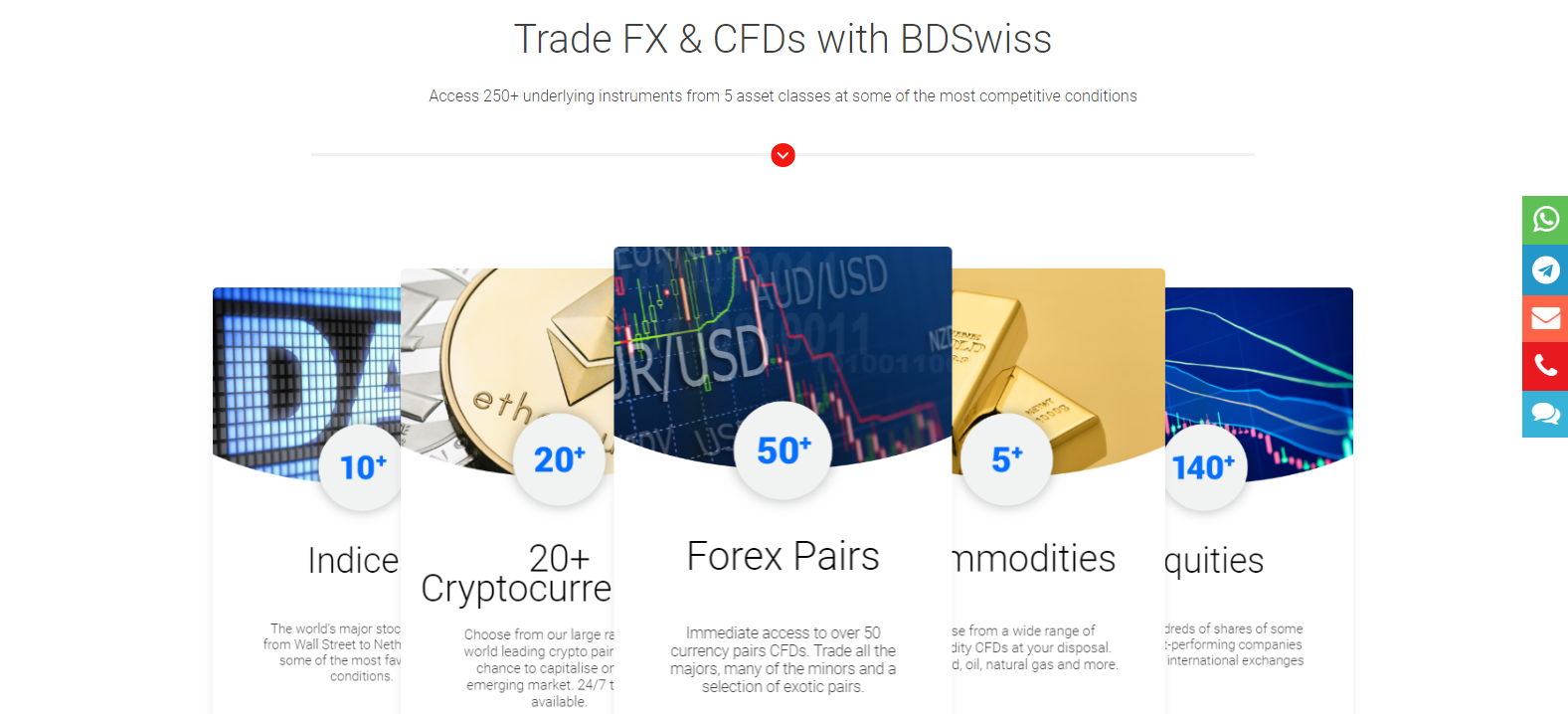

We were happy to see during our BDSwiss review that asset selection at BDSwiss is ample but largely dependent on the asset sector chosen. The Forex market represents the most adequately covered sector with 51 currency pairs. Seven commodity CFDs provide traders with an introduction into this asset class. Surprisingly,with 21 cryptocurrencies, this broker offers a fairly substantial range of choices, which is quite refreshing given that this is an area often neglected by brokers. Completing the offering of this broker are 12 index and 138 equity CFDs. New traders will find this a suitable choice for educational purposes, though advanced traders looking for highly specific assets may find something missing.

Over 250 assets are advertised. Equities available for trade are country dependent.

Back to Top

Account Types

Three account types are provided by BDSwiss. The Classic and VIP accounts carry an average spread of 1.5 pips and 1.1 pips, respectively. Forex traders will likely find a lower cost structure in many entry-level accounts at other brokerages even against the VIP account offered at BDSwiss. The Raw account consists of adequately priced spreads, and a fixed commission of $5 per traded lot on all currency and gold pairs.Islamic accounts are available on request.

Back to Top

Trading Platforms

BDSwiss' platform arsenal includes the MetaTrader4 and MetaTrader5, as well as the natively developed WebTrader and its multi-awarded mobile app that enables users to create an account, deposit, trade and withdraw all on their iOS or Android device.

While the most basic version of the MT4/MT5 versions are granted, there is an optional Autochartist plugin for the MT4 but any other EAs and plugins need to be downloaded independently by BDSwiss traders. Numerous free upgrades are available, however, the upgrades that are necessary for experienced traders may be costly. Moreover, the MT5 platform lacks backward compatibility, rendering it an inconvenientoption to traders with existing solutions developed on the MT4 infrastructure.

The BDSwiss Webtrader is advertised as a feature-packed platform but it lacks support for automated trading solutions. As such, it represents a less capable version of the MT4/MT5 web versions. Automated trading is marketed with the use of pending orders, failing to capture the essence of this emerging sector.

BDSwiss Mobile App

Fully developed in-house, BDSwiss Mobile App enables traders to manage their account and trade on the go. Overall, BDSwiss' Mobile App is highly intuitive and responsive. Users can register for an account, deposit, withdraw, upload their KYC and of course place their trades anytime, anywhere.

- Real-time Quotes

- Interactive Charts

- In-Built User Tutorials

- Live Chat & Support

- Clean, User-Friendly Interface

- Full Trading & Transactions History

- Deposit and Withdraw Functionalities

- Account Set-Up & KYC Verification

- 24/7 Cryptocurrency Pairs Trading

The MT4 trading platform is available as the most basic version.

Manual traders who have no need for advanced features may find the MT5 trading platform a better choice.

The BDSwiss WebTrader is worth exploring if you're looking for a MetaTrader alternative. The WebTrader does not require downloading and it is fully synchronised to the downloadable versions of the MT4. There are more than 24 languages available, and overall it's an easy-to-use, clean platform that you can access quickly and efficiently on any device.

Back to Top

Research and Education

Two analysts provide market coverage on the BDSwiss blog, Technical Analyst Frank Walbaum and BDSwiss Head of Investment Strategy and renowned fundamentalist Marshall Gittler. A mix of fundamental and technical analyses are uploaded daily. The quality of written content is decent; the exception is the coverage of market insights which are provided by Marshall Gittler, the head of the BDSwiss research team, who previously worked at other brokers including FXPRIMUS and IronFX. Mr. Gittler's analysis is often quoted by major media such as Reuters, CNN and Bloomberg. Technical Analysis briefs provide a sample of BDSwiss Trading Alerts Service by giving traders Frank Walbaum's daily setup along with Entry point, Stop Loss and Take profit levels as well as a brief technical analysis on the specific asset.

The broker's Telegram channel, which consists of a Free basic version accessible by anyone and the VIP version which is exclusive to premium account holders (VIP and Raw Account) is utilized to provide real-time Trading Alerts as well as notify clients on important releases, volatility alerts and upcoming live-trading webinars. The impression given is that BDSwiss executes its trading signals with the alerts created by its lead portfolio manager, Frank Walbaum.

Autochartist, generated by a third party, provides manual traders with a useful tool that scans assets for market patterns and trading opportunities and, thus, can give traders a significant edge. The BDSwiss blog provides traders with access to their research and insights.

The head of the BDSwiss research team provides high quality market insights.

BDSwiss touts proven strategies in its Telegram channel, accessible only to VIP and Raw account holders. BDSwiss also provides a full history of the Success Rate of its Trading Alerts service.

Autochartist is available to all traders and represents a valuable research tool.

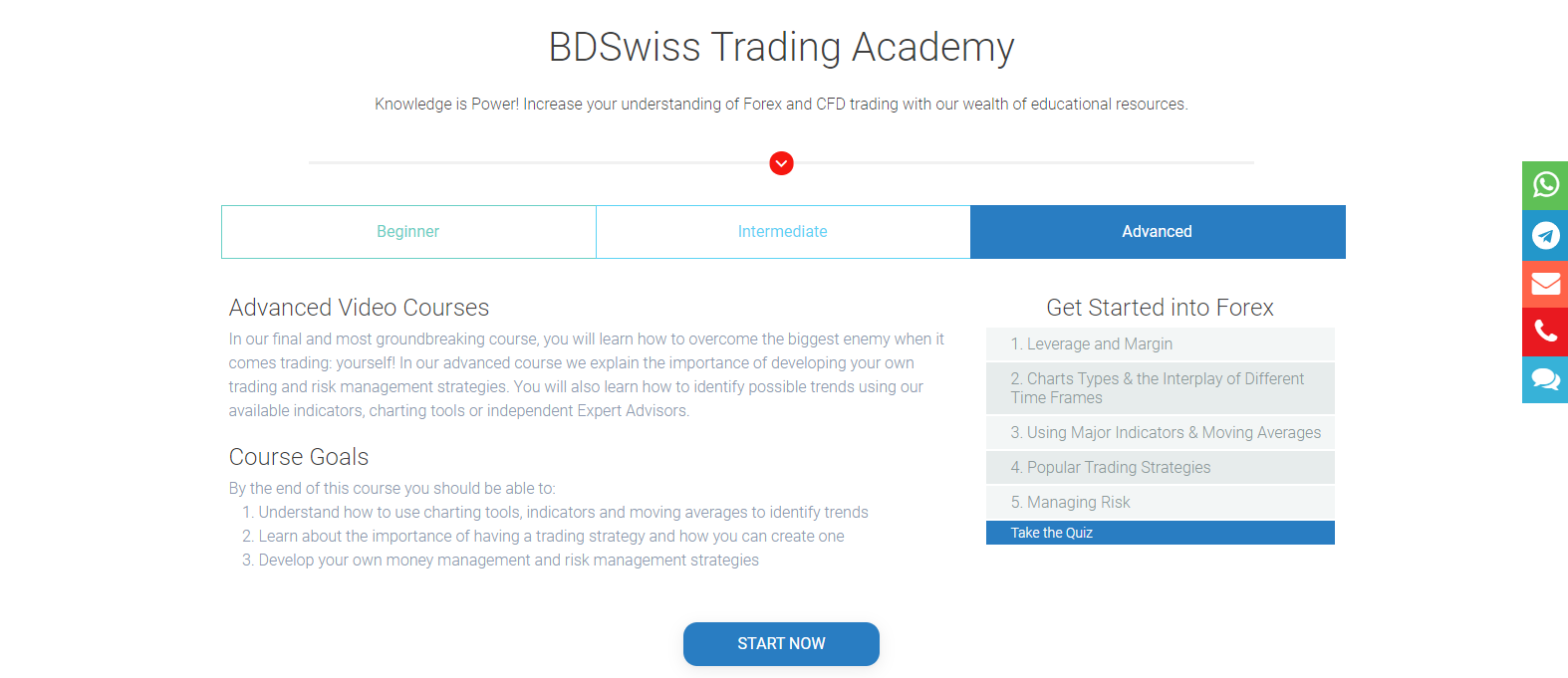

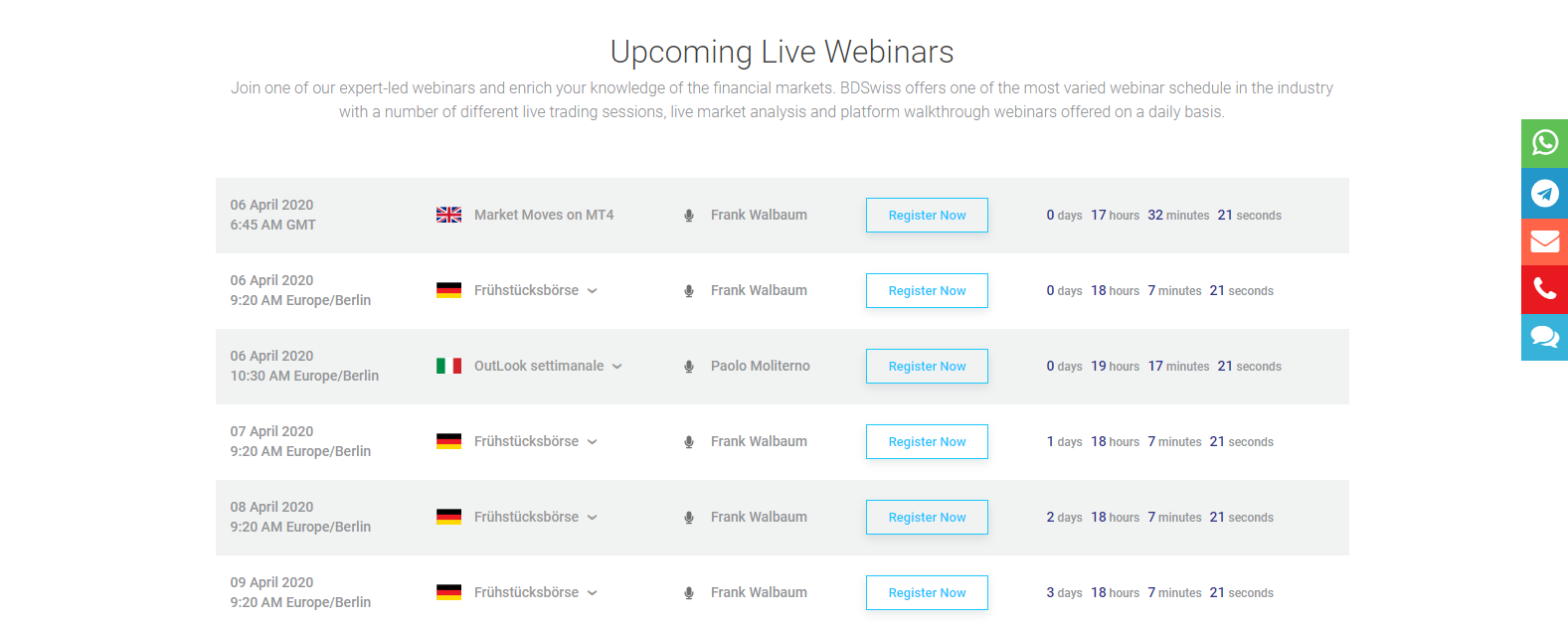

The education section is where BDSwiss clearly placed their visible effort. At the core is the Trading Academy, categorized into Beginner, Intermediate, and Advanced lessons. Each section consists of five to six video lessons with a quiz to summarize the content. It provides a great introduction to trading. Enhancing educational content are Live Webinars in English, German, and Italian. Registration is required, but attendance is free of charge.

Trading Talks is a 10-course recurring educational webinar which is held every two weeks. The BDSwiss official YouTube channel is where past webinars can be accessed. Over 200 videos are in the expanding library, allowing traders to learn at their own pace. Completing the educational service are seminars.

The education section at BDSwiss fulfills an essential role at this broker. Overall this category represents the most valuable aspect of BDSwiss.

The Trading Academy offers new clients a well-rounded introduction to trading.

Live webinars provide an additional educational channel.

Trading Talks is a 10-course recurring webinar, further aiding the education of new traders.

Over 200 videos are available on the BDSwiss official YouTube channel.

BDSwiss recently hosted seminars, with expectations of more to come.

Back to Top

Customer Support

A multilingual customer support that is available 24/5 is easily reached via e-mail, webform, phone, WhatsApp, Telegram, or live chat; a callback option is also available. In general, BDSwiss comes across as a well-managed brokerage, and traders are unlikely to require assistance. In case the need does arise, this broker has made accessibility a high priority. An FAQ section attempts to answer the most common questions.

Back to Top

In Europe, BDSwiss does not offer bonuses or exclusive promotions due to regulatory restrictions. For non-EU clients registered under FSC Mauritius (www.bdswiss.com) there are standard referral promotions and frequent competitions based on trading-volume.

Back to Top

Opening an Account

A user-friendly online application processes new account openings per industry standard. BDSwiss notes the process takes less than 49 seconds to complete. It will grant new traders access to the back-office from where accounts require verification, as stipulated by regulators to satisfy AML/KYC requirements. New traders must submit a copy of their ID and one proof of residency document to complete the account opening process, together with two questionnaires.

Back to Top

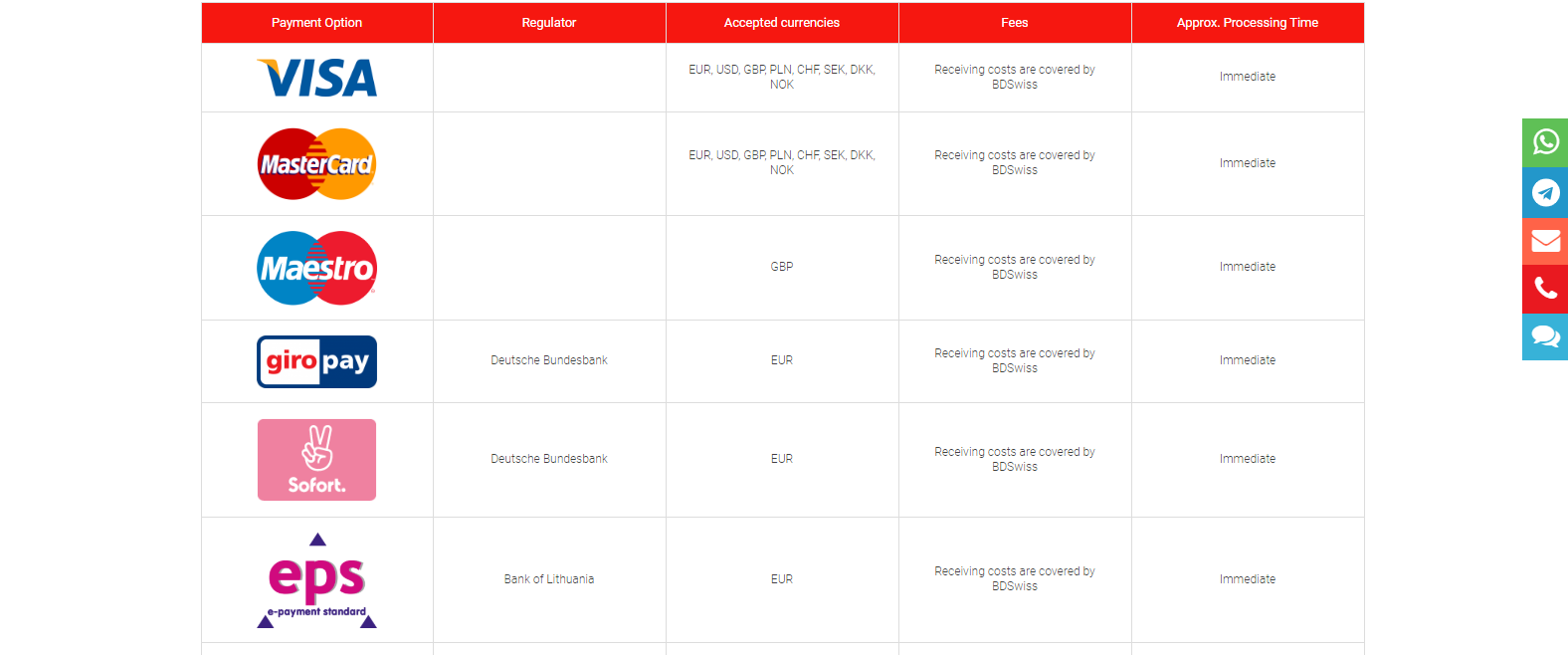

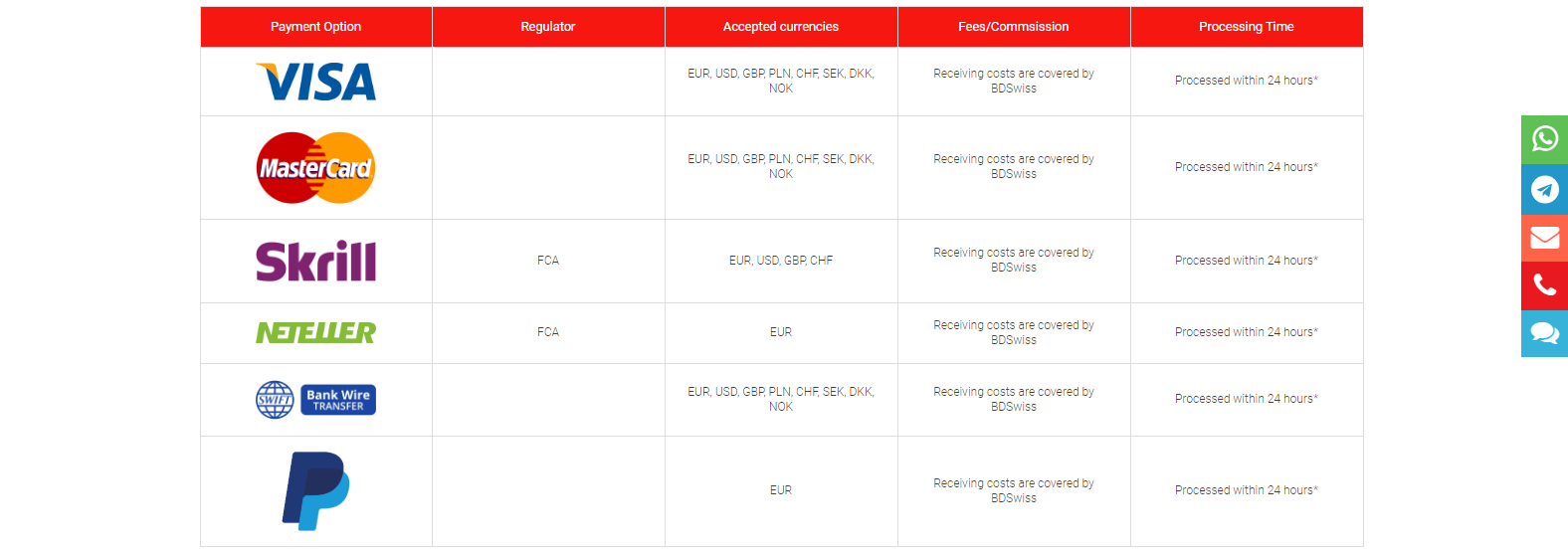

Deposits and Withdrawals

Traders have numerous deposit options from which to choose. Besides traditional bank wires and credit/debit cards, supported payment processors include Skrill, Neteller, PayPay, giropay, Sofort, eps, iDeal, and dotpay. The minimum deposit amount is dependent on the selected method. Immediate processing times refer to BDSwiss deposits only (via payment processors); as is standard, bank wires may take between four and seven business days to arrive. Per regulatory requirements, the name on the deposit account and trading account must be identical. All withdrawal requests are processed internally within 24 hours.

BDSwiss lists twelve deposit methods with instant processing times.

Only five withdrawal options are listed, which was a bit surprising.

Back to Top

Unique Features

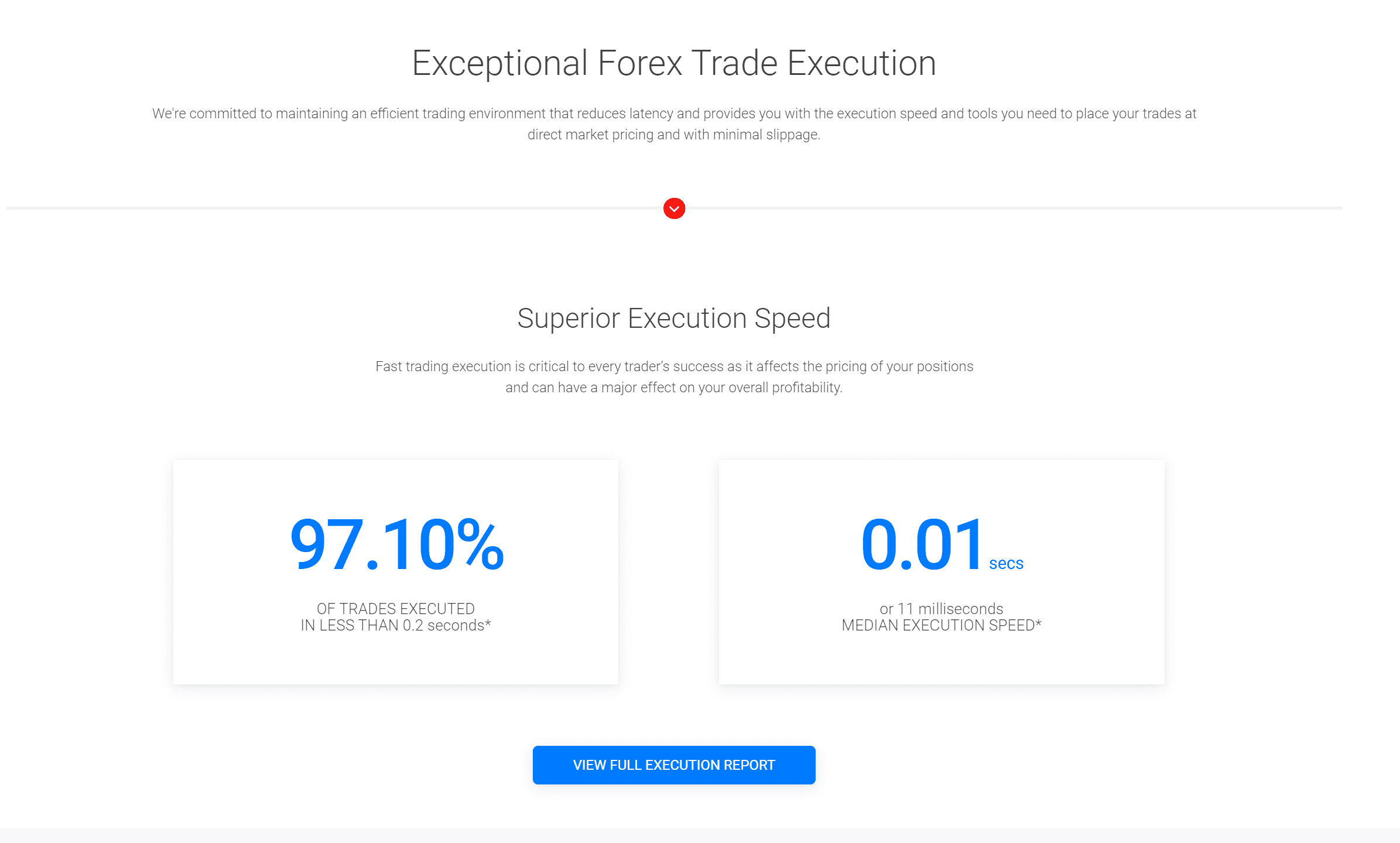

The most notable feature we discovered during this BDSwiss review is the advertised trade execution which is certainly worthy of a mention. With zero requotes and 73.40% of zero or positive slippage, on paper, the statistics suggest an excellent execution environment. Also of note is the company's excellent research and education offerings which will be outlined below.

Company Information

- Broker's Name : BDSwiss

- Headquarters : Cyprus

- Regulation : CySEC, NFA, FSC

Account Information

- Type of Broker : Market Maker

- U.S. Clients Allowed :

- Minimum Deposit : 100 USD/EUR/GBP

- Maximum Leverage : 1:30 (CySEC), 1:500 (FSC)

- Commissions / Spreads : Medium

- Account 1 : Classic

- Account 2 : Raw

- Account 3 : VIP

- Demo Account :

- Islamic Account :

- Segregated Account :

- Managed Accounts :

- Institutional Accounts :

- Deposit Options :

- Withdrawal Options :

Instruments Traded

- ETFs :

- CFDs :

- Commodities :

- Metals :

- Stocks :

- Oil :

- Gold :

- Binary Options :

- Indices :

Trading Platforms

- Type of Platform : MetaTrader 4, Web-based

-

-

Platform Languages :

- English

- Dutch

- Greek

- Malay

- Thai

- Bahasa

- Swedish

- Polish

- Hungarian

- Portuguese

- Russian

- Spanish

- Arabic

- Italian

- French

- Turkish

- German

- Japanese

- Chinese

- Other

-

-

-

OS Compatibility :

-

- Trading Signals :

- Charting Package :

- Market Analysis :

- Chart Trading :

- Automated Trading :

- Scalping :

- Hedging :

- Mobile Alerts :

- E-mail Alerts :

- Trailing Stops :

- Guaranteed Stop Loss :

- Guaranteed Limit Orders :

- Guaranteed Execution :

- One-click Execution :

- OCO Orders :

- Interest on Margin :

- Web-based Trading :

- Mobile Trading :

Customer Support

-

-

Website Languages :

- English

- Spanish

- Italian

- French

- German

- Chinese

- Polish

-

- Support Hours : 24/5

- E-mail Support :

- SMS Support :

- Chat :

Back to Top

FAQ

Is BDSwiss reliable?

CySEC and FSC regulation provides an adequate layer of security, and this broker has been compliant with all stipulations. Traders may trust BDSwiss with personal data and capital, as a reliable operation is in place.

Processing times are noted as 24 hours, referring to internal procedures. Wire transfers may take from four to seven business days to arrive. Most payment processors will complete a transaction instantly after being initiated by BDSwiss.

BDSwiss Holding PLC is located in Cyprus, BDS Markets in Mauritius, BDSwiss LLC in the US, and BDSwiss GmbH in Germany.

Back to Top

Summary

BDSwiss Group operates on a near-global scale under different entities and regulators. With 200+ personnel, BDSwiss Group's holding company is located in Zug, Switzerland and maintains its operating offices in Berlin, Germany and Limassol, Cyprus.

The primary regulator is located in Cyprus, secondary regulatory is based in Mauritius, and one operating subsidiary is registered with theNFA. A BaFin-Tied Agent is registered in Germany.

Traders will find four maintrading platforms that are fairly intuitive and responsive, average execution speed is 0.01s. The biggest benefits offered by BDSwiss are the ample asset selection and the company's research offerings.

The research team is led by a renowned fundamental analyst. The broker provides 24/5 market news coverage through daily and weekly reviews as well as quarterly outlooks, video briefs and special reports. There are a series of free live trading and educational webinars being offered on the daily in more than 5 languages. Webinars include market morning briefs, live trading sessions during key events, platform walkthroughs, Trading-Talks webinars hosted by Frank Walbaum and an exclusive co-hosted webinar with Marshall Gittler offered every Monday. Education is where BDSwiss has clearly invested time and effort; they have created an outstanding introduction to trading for new clients to consider.

The potential for BDSwiss to provide a significantly more client-friendly environment is great and clearly evident. Overall, BDSwiss is a fast-growing broker with a competitive and transparent environment that can cater for the needs of traders looking for a broker that combines award-winning conditions, exceptional execution, quality education and optimal support.

Back to Top

User Reviews

Did you have a good experience with this broker? A bad one? Tell our team and traders worldwide about your experience in our User Reviews tab. Your email address will not be posted.

Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Comments including inappropriate, irrelevant or promotional links will also be removed.

Back to Top

Bd Swiss Forex Trading Platform Review

Source: https://www.dailyforex.com/bdswiss/bdswiss-review/971

0 Response to "Bd Swiss Forex Trading Platform Review"

Post a Comment